Former President Donald Trump's recently made public tax returns have provided insight into his company losses, intricate tax arrangements, and tax payments throughout his time in office.

Experts think they are unlikely to have a significant political influence as he considers another presidential bid.

The records showed that Mr. Trump paid just $750 (£622) in federal taxes in 2016 and 2017 and no federal taxes at all in 2020.

In 2018, he paid a little over $1 million, nevertheless.

The data were made public after a protracted court struggle, and Mr. Trump criticized the publication and warned that it would widen the political rift in the US.

"The returns," he said, "demonstrate how triumphantly successful I have been and how I was able to utilize depreciation and numerous other tax deductions as a motivator for generating thousands of jobs and wonderful buildings and companies."

While it is not required by law, it is customary for presidents to release their tax returns.

Like all employees, US presidents get a salary, but many also make money from their own companies and assets.

Tax returns and accompanying paperwork for Donald Trump, the Donald J. Trump Revocable Trust, and seven business companies are among the recently made public records.

They merely make up a small portion of the former president's 400+ different economic holdings.

How Donald Trump's business losses drastically cut his tax liability?

After years of work, Trump's tax returns have been made public.

From 2016 through 2019, Mr. Trump paid $1.1 million (£906,587) in federal income taxes, all but $1,500 of which were made in a single year, according to data that was previously made public. In 2020, the last year of his presidency, he didn't pay any taxes.

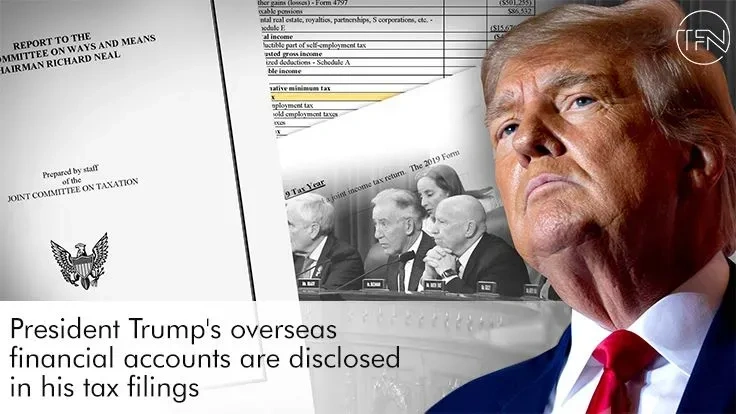

The records also reveal that Mr. Trump owned bank accounts in China, Ireland, and the United Kingdom between 2015 and 2017, during which time he conducted worldwide business.

The international accounts were noteworthy because Mr. Trump was president of the United States in 2017, giving him enormous influence over US foreign policy.

Beginning in 2018, Mr. Trump only acknowledged having a UK account.

The documents also reveal that the US government agency in charge of tax collection, the Internal Revenue Service, did not audit Mr. Trump during the first years of his administration. Instead, it started doing so in 2019 after Democrats demanded access to his tax returns.

Democratic lawmakers criticized the discovery. The IRS auditing system is flawed, according to Don Beyer, a member of the committee that reviewed the data release, and Congress must do far more to ensure equitable tax enforcement in this nation.

The IRS said that "it is not practicable to acquire the resources available to analyze all potential concerns" related to Mr. Trump's many business holdings in a document that was mentioned in an earlier story.

Even for experts, according to Syracuse University professor Maryanne Monforte of accounting techniques, the tax returns are a maze.

She stated, "He's the classic businessman and he's got his hands in everything." "His background in real estate adds to the intricacy of appraisals, revenues, losses, and depreciation. All of this implies that his return has a level of intricacy that other billionaires would not have."

Does it matter whether the tax records are released?

However, analysts from both ends of the US political spectrum agree that Mr. Trump's standing among his core followers won't be much affected by the results.

Short of something that would be a blatant legal breach, nothing in there will matter at all, according to former Republican National Committee spokesperson Doug Heye.

"No Trump fan would say, "Oh, I can't vote for him anymore," the man said. "Despite not having seen Trump's taxes, we have seen this before. Nobody's opinion is being altered by this."

Trump supporters won't be persuaded by anything, according to Democratic strategist Ameshia Cross.

Theirs is Undecided voters or Republicans looking for an alternative to Mr. Trump may see the records as proving that his financial expertise "wasn't truly what he was making it out to be," she said, adding, "Quite honestly, I don't believe this matters."

That would essentially suggest that the whole platform on which he conducted his campaign was a lie, she added. This reveals something he had been attempting to conceal for a long time.

How much tax did other presidents pay, and how does Trump stack up?

Compared to other previous presidents, Mr. Trump paid a far less percentage of his income in certain years. He and his wife had an adjusted gross income of $24.3 million in 2018. However, he paid less than $1 million, giving him a tax rate of just 4.1%. In the US, couples filing jointly.

In other years, Mr. Trump's tax burden was considerably higher than what he seemed to earn on paper because he recorded enormous business losses. For instance, he lost money in 2017 but still paid taxes.

In contrast, the highest year of Barack Obama and Michelle Obama's taxable income was 2009, when they earned $5.5 million and paid nearly 30% in taxes. The majority of their money came from the sales of Mr. Obama's two books, Audacity of Hope and Dreams from My Father.

Mr. Obama's taxable income significantly decreased as his book sales decreased; in 2015, the pair made about $447,880 in total, virtually entirely from his presidential salary, and they paid around 18% of their income to the IRS.

After leaving office, George W. Bush wrote his presidential biography. While he was president, he and his wife Laura Bush earned an average of roughly $800,000 each year. The majority comes from salary, with the remaining 50% coming from investments and interest. Their average tax rate was 27.8%.

Starting in 1992, Bill and Hillary Clinton made little under $300,000 a year, largely from wages, and paid 23.6% of their income in taxes. The couple made almost $1 million in 1996 because of Mrs. Clinton's book, but their tax rate decreased to 18.5%.